French VC firm Idinvest has compiled some data about the European tech ecosystem. The firm has decided to focus on consumer tech in general, and there are some interesting trends that I’m going to break out here. You can read the full report here.

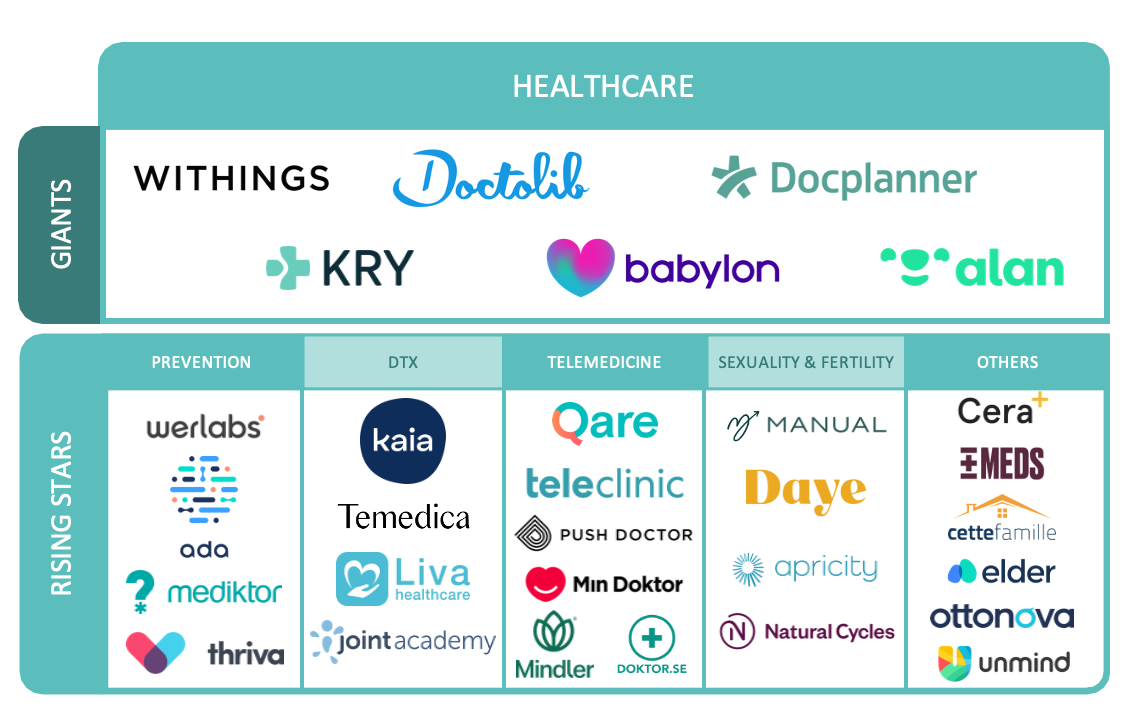

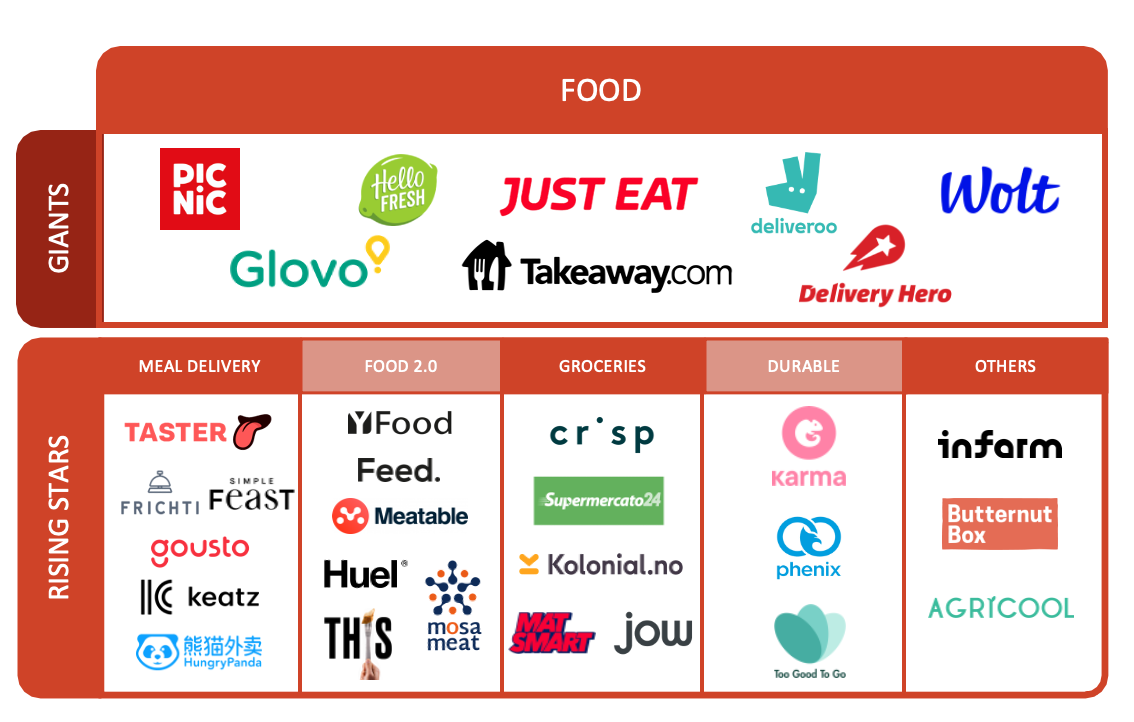

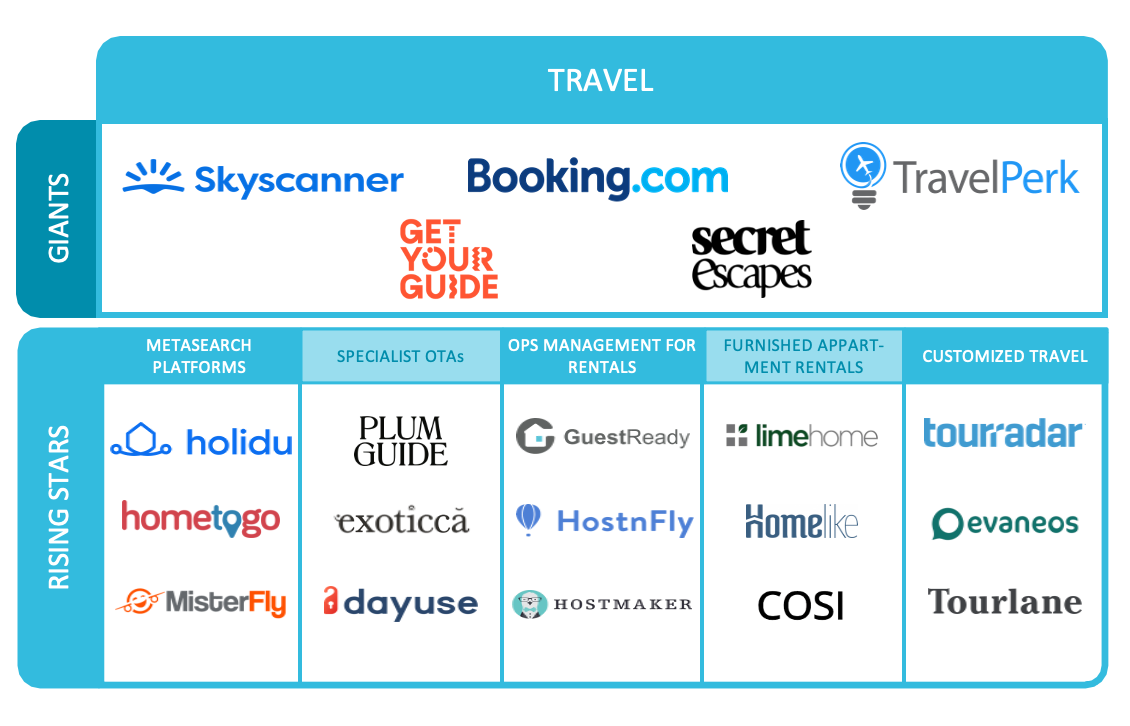

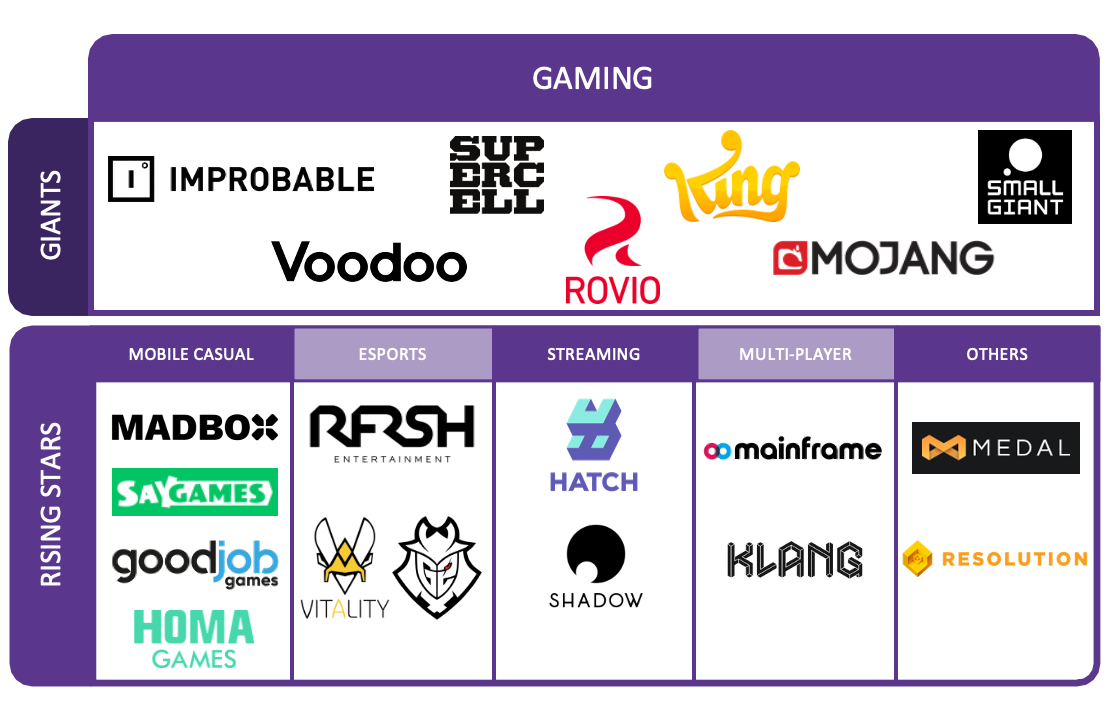

The team has analyzed and surveyed 1,500 companies over multiple months. And Idinvest has identified rising stars in multiple different verticals, such as fintech, mobility, healthcare or travel. If a startup has raised more than €100 million or has been acquired, Idinvest considers them as giants already.

Lesson #1: VC funding is growing at a faster pace in Europe than in the rest of the world

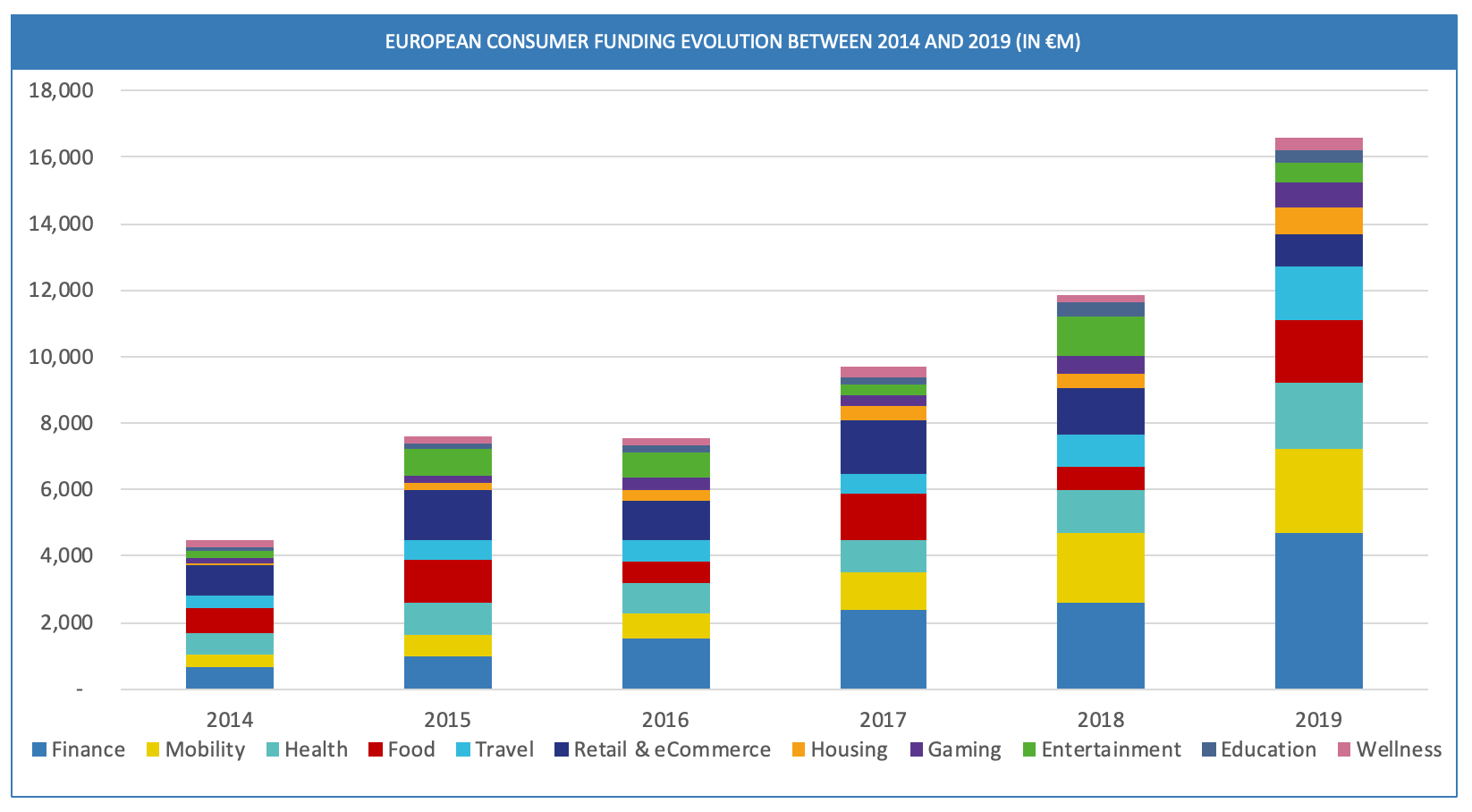

Notice that jump from €4.4 billion in 2014 to €16.6 billion in 2019.

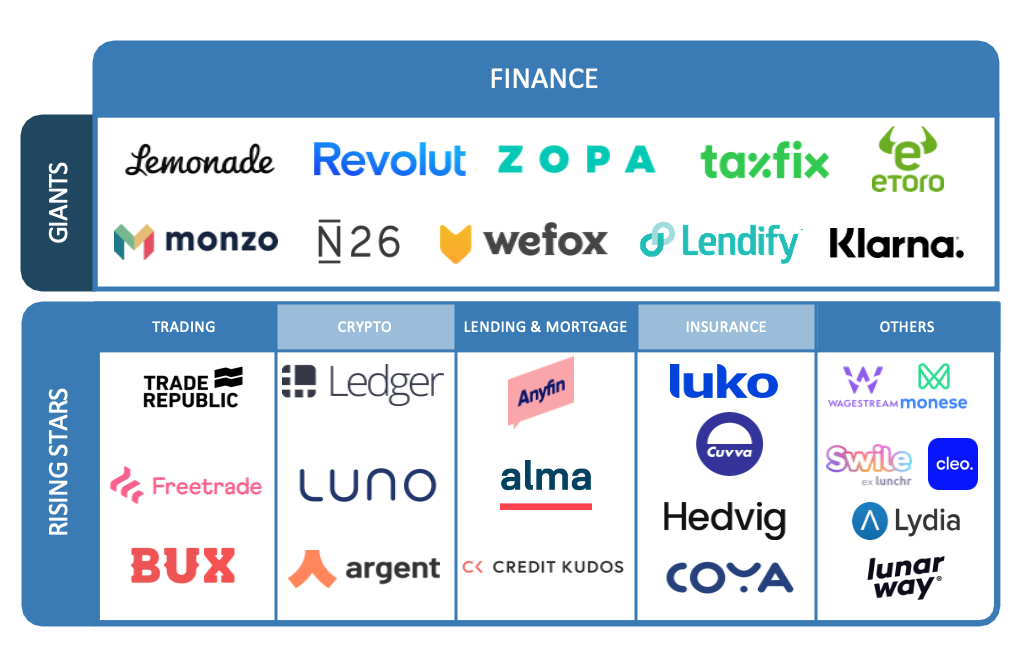

Lesson #2: The European fintech boom is real

Fintech is now the largest vertical in Europe. On average, European startups attract 16% of global VC investments. But Europe is grabbing a bigger piece of that pie with fintech as European fintech startups have attracted 26% of total VC investments in that space.

And it’s not just challenger banks, such as N26, Monzo or Revolut. There are trading startups, lending startups, API-driven companies and more.

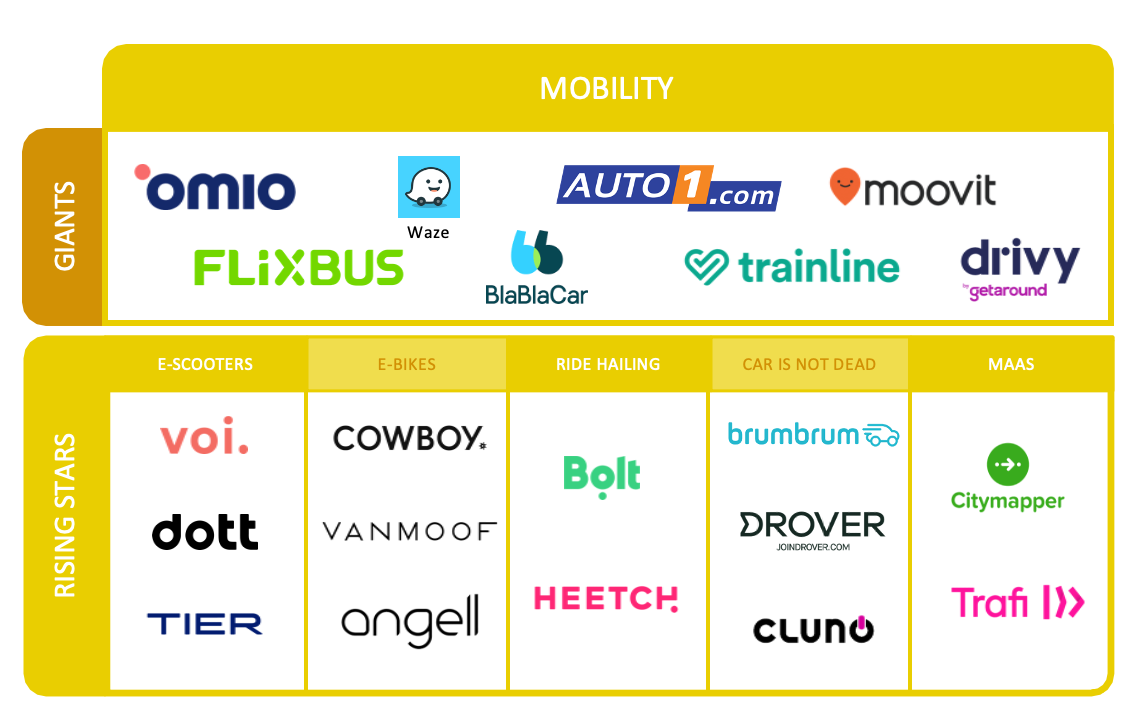

Lesson #3: Mobility is fragmented

While mobility is a huge vertical in Europe, there are countless of players that do more or less the same thing — multiple scooter startups (Voi, Dott, Tier…), multiples ride-hailing startups (Bolt, Heetch, FreeNow, Cabify…), etc.

Some of them are thriving, but you’re not going to see any of the big names you’d expect in the list of giants as those companies are not European — Uber, Didi, Bird… In other words, Europe is mostly a fast follower in this space, and it’s been working fairly well.

Lesson #4: Health is regulated as hell

This isn’t surprising, but European healthcare startups seem to be mostly active in Europe. Similarly, American healthcare startups don’t seem to have a huge presence in Europe.

I personally think European healthcare startups have a shot at becoming global leaders for two reasons. First, it’s a privacy-sensitive industry and European startups tend to care more about privacy due to the legal framework. Second, the tech lash against big tech companies, such as Google, Facebook, Amazon, Microsoft and Apple, is going to be particularly strong with healthcare products.

Lesson #5: Food startups could reshape cities

Let me quote Idinvest’s report directly here because it is spot on: “In the Middle-Age, posting houses became inns to feed and offer rest to travelers. In the 20th century, McDonald’s restaurants grew exponentially around the U.S. road infrastructure. In the past 18-24 months, we have seen the rise of dark kitchens (Keatz, Taster) and dark groceries (Glovo) which are both piggybacking this new food delivery infrastructure and adding to it a real estate layer. Dark kitchens and groceries are selling products exclusively through delivery. The customer facing location of a restaurant or a grocery shop is replaced by a cheaper real estate location optimized for order preparations.â€

Lesson #6: Travel is a bigger industry in Europe than in the U.S.

Tourists spend more money in Europe than in the U.S. Given that many travel startups start with a simple marketplace to improve liquidity, pricing, listings, discovery or open up a whole new segment, it makes sense to start it from Europe.

Lesson #7: Gaming is big in Europe

Gaming, and in particular mobile gaming, has been thriving in Europe. Many casual games have emerged from European startups. There’s no European Netflix, but Minecraft, Candy Crush Saga and Angry Birds were all born in Europe.

All the rest

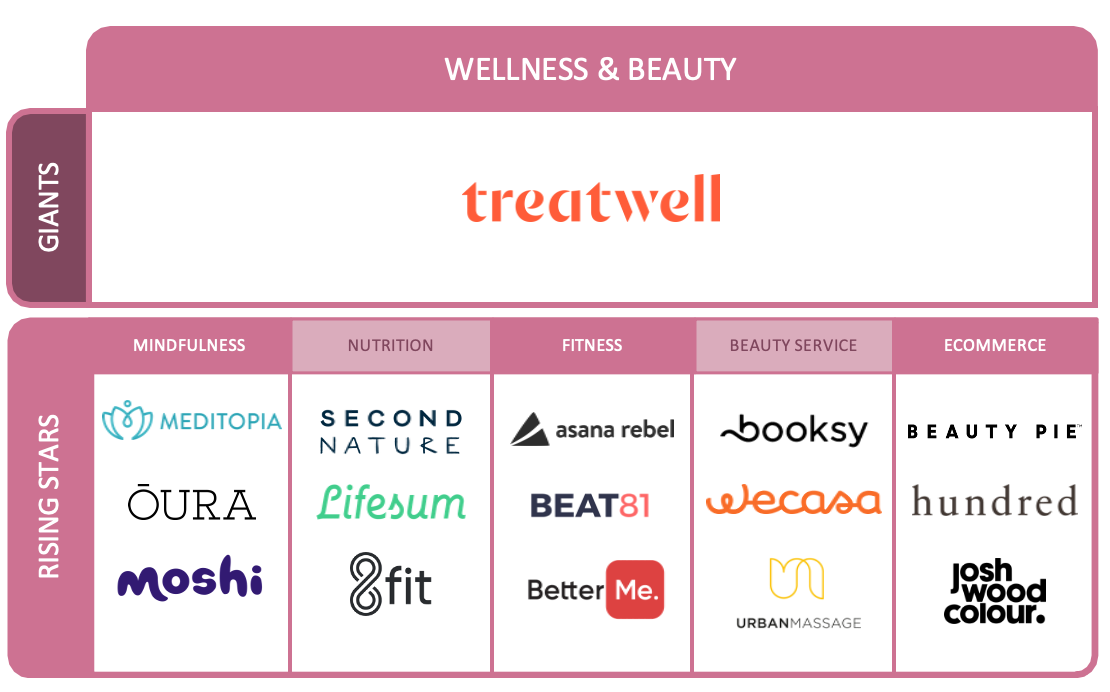

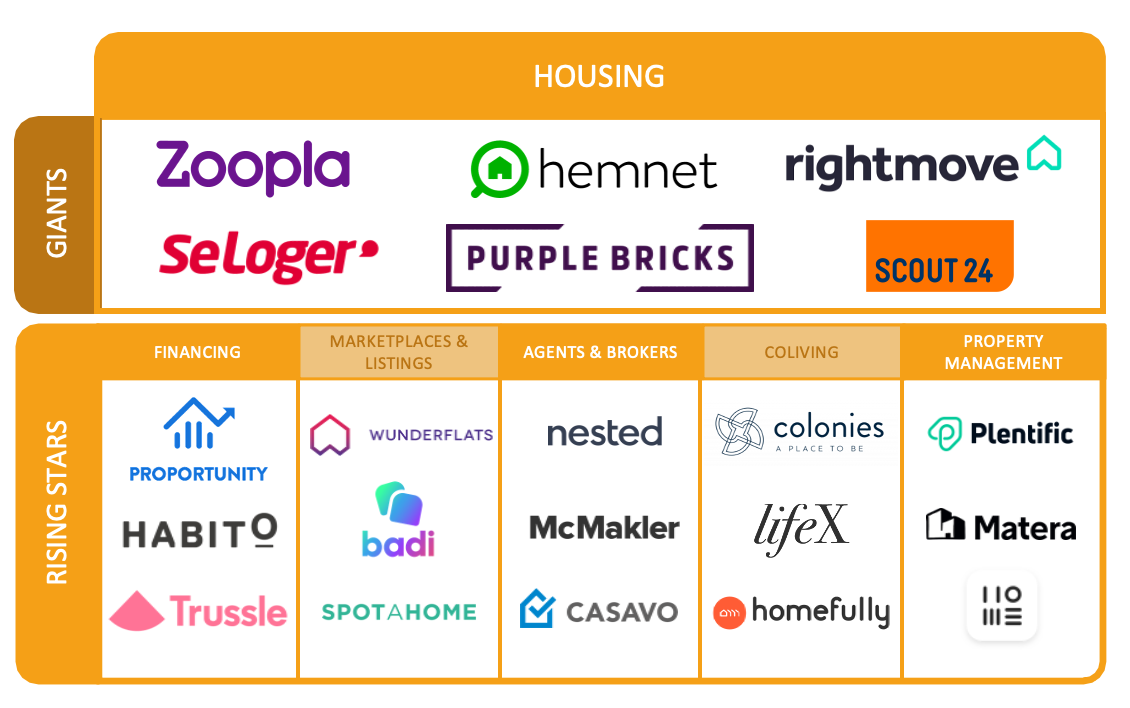

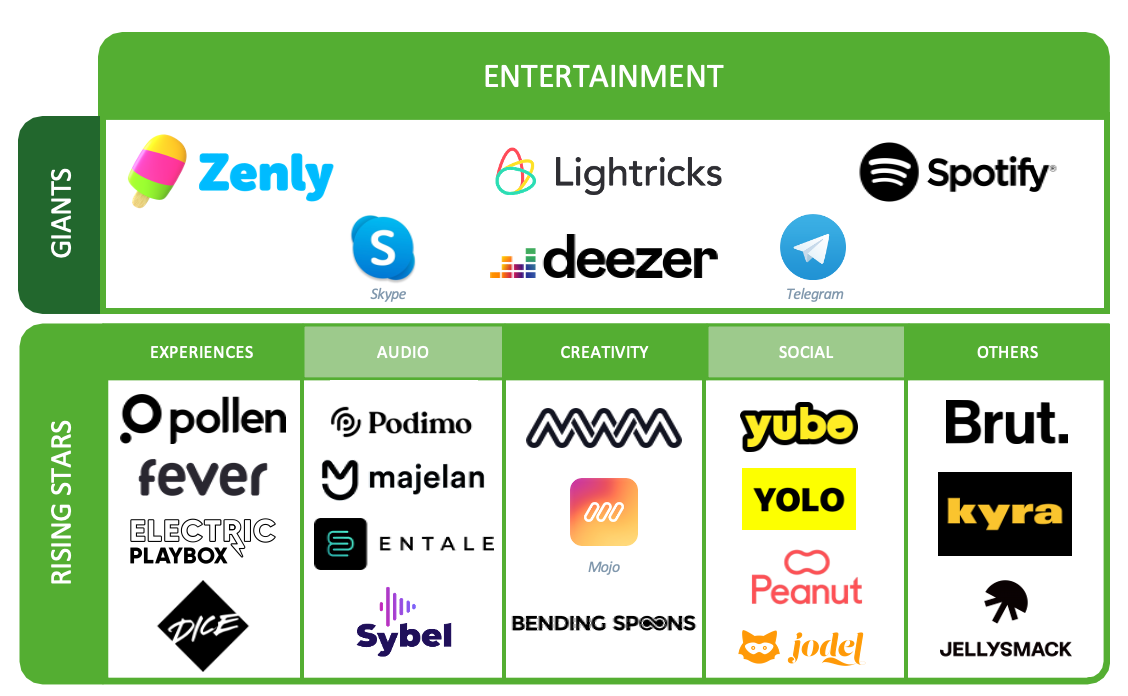

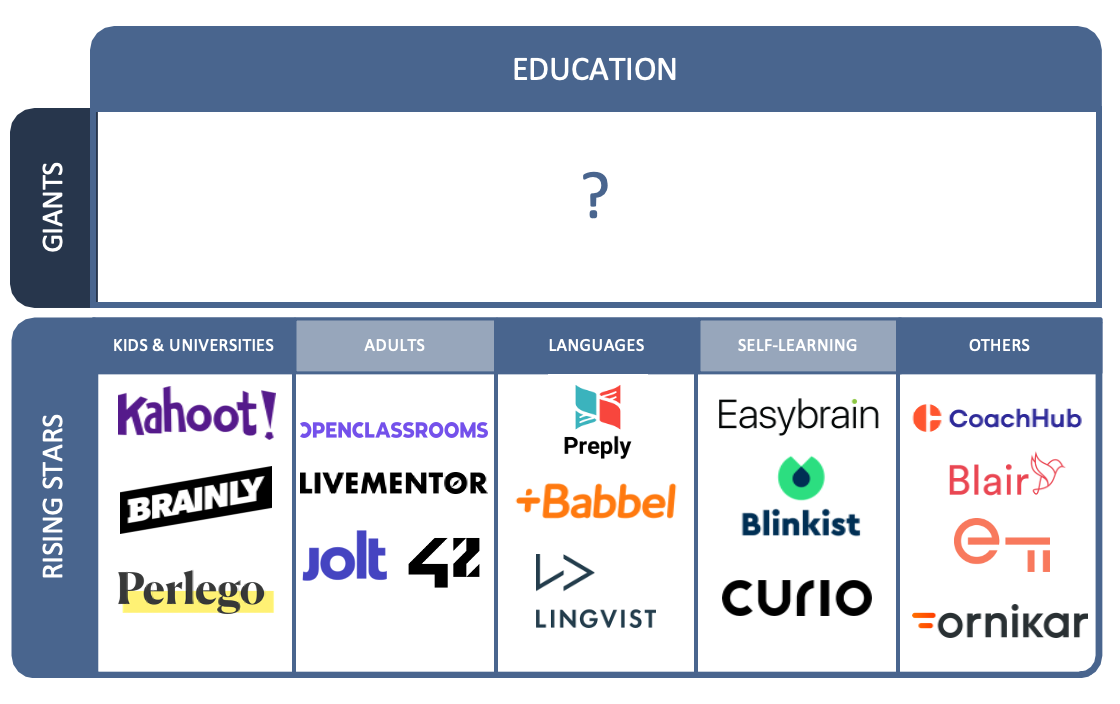

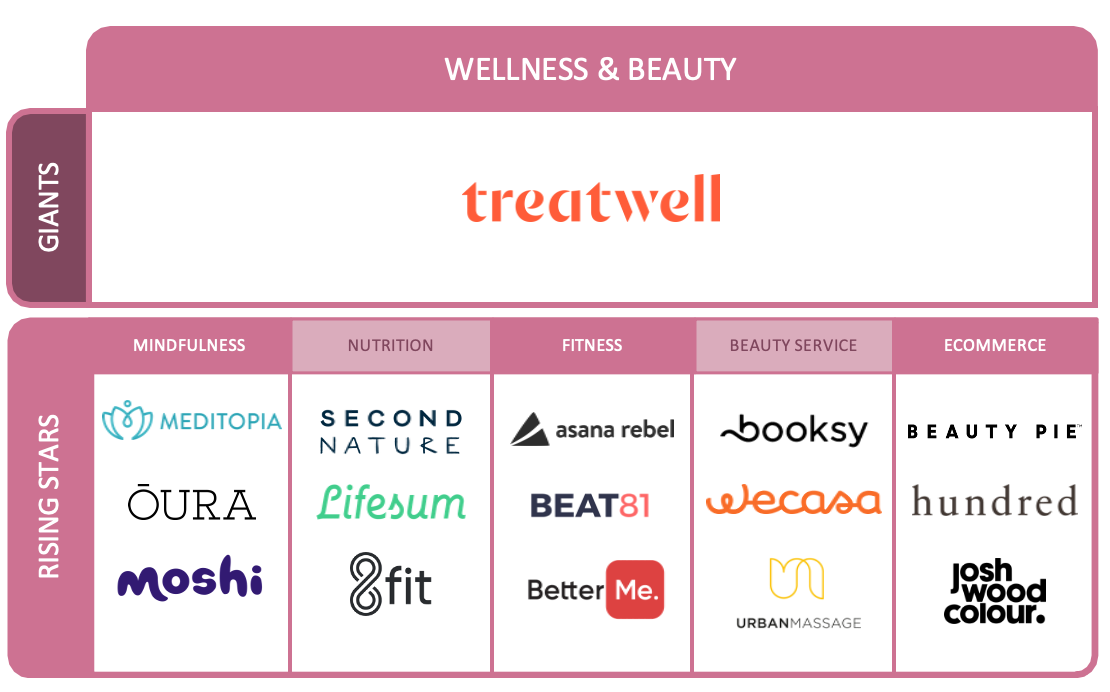

Idinvest’s report covers other verticals but I don’t have much to add. I’m just going to share the mapping of those verticals and you can read the report if you want to dig deeper.

Click here for more...

from #Bangladesh #News aka Bangladesh News Now!!!

No comments:

Post a Comment