Memo Bank wasn’t always called Memo Bank. It originally started as Margo Bank and it has been flying under the radar for a few years. The French startup is now about to launch publicly and shared more details about what it is building.

As the name suggests, Memo Bank is a bank. It plans to server business customers exclusively and it targets small and medium companies that generate over €2 million in annual turnover and have more than 10 employees.

Jean-Daniel Guyot, the co-founder and CEO of Memo Bank, previously founded Capitaine Train, which later became Captain Train, which later was acquired by Trainline. Capitaine Train disrupted online train ticket sales in France as the national railway company basically had a monopoly.

When you’re creating a bank, you’re also entering a highly regulated market. And Memo Bank’s team is aware of that and wants to create a barrier to entry with its competitors while providing a different service compared to legacy players.

Memo Bank is a credit institution and has obtained the proper licenses from the French regulator (ACPR) and the European Central Bank. “It’s a unique event in France, it hasn’t happened since 1970,†Guyot said in a press conference.

“You don’t build a bank in a garage with a few thousand euros,†he added in order to set his startup apart from other fintech startups.

The startup has raised a $22.5 million (€20 million) funding round from BlackFin Capital Partners, existing investor Daphni and Bpifrance. Founders Future and a ton of business angels are also joining the round — Alexis Bonillo, Antoine Martin, Marc Simoncini, Nicolas Steegmann, Oleg Tscheltzoff, Paulin Dementhon, Pierre Valade, Rachel Delacour, Sarah Meyohas, Thibaud Elzière, Xavier Niel…

The former CEO of Arkéa Ronan Le Moal is also taking a seat at the table as chairman of the board. Memo Bank had previously raised $7.6 million (€6.7 million) in 2018.

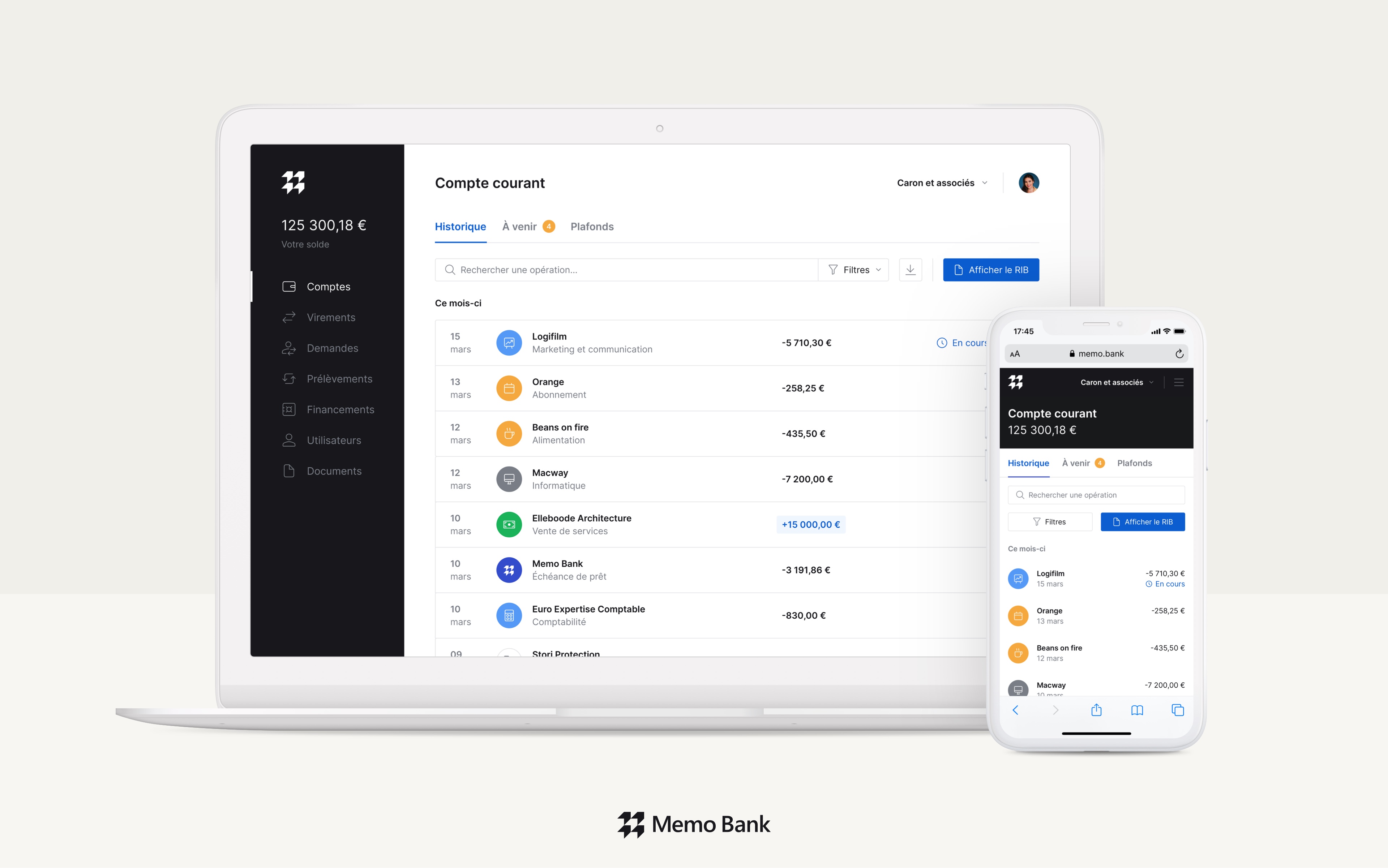

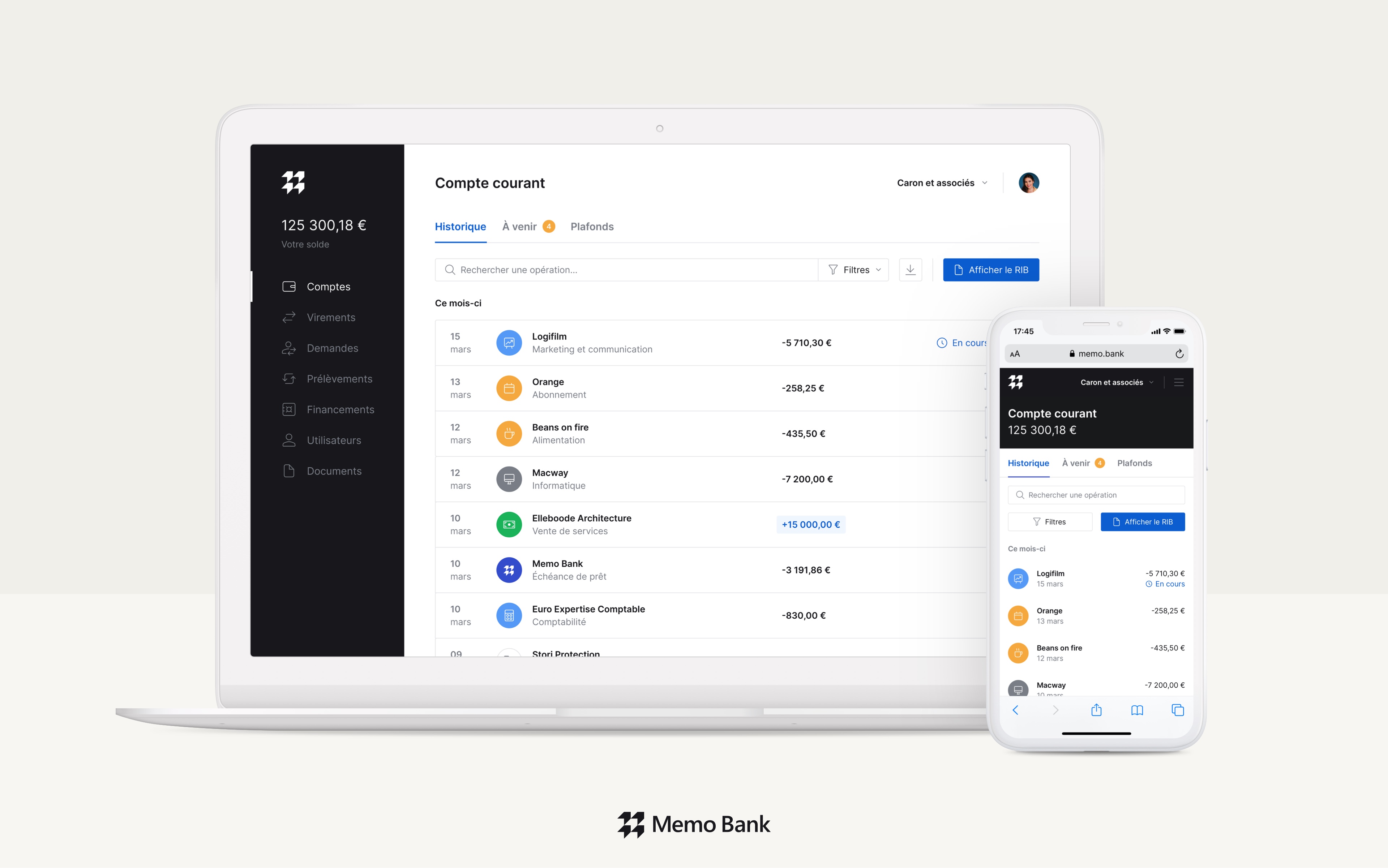

So what is Memo Bank exactly? You’ll have to wait a few months if you want to become a client. The company has developed its own core banking infrastructure and wants to offer everything you’d expect from a business bank.

It starts with a bank account that doesn’t suck. “It seems obvious but believe me it’s not,†Guyot said. Many business banks don’t let you add team members without sending a letter. Or you can’t browse transactions that are older than three months in the web interface.

But the real product is credit. Memo Bank wants to offer credit lines in just a few days without any cumbersome paperwork. Memo Bank’s biggest competitor isn’t neobanks. The startup is competing directly with online lending platforms, such as October.

At first, Memo Bank is going to accept clients in the Paris area. While the company won’t have any physical branch, it wants to be able to come and talk to you directly. It’ll expand to Lyon and then other French cities in the next years. Eventually, Memo Bank hopes it can attract 4,000 clients within four years.

Click here for more...

from #Bangladesh #News aka Bangladesh News Now!!!

I felt very happy while reading this article. we provide fake credit card online. for more info visit our website.

ReplyDelete