Strong e-commerce sales are predicted to help lift overall holiday retail spending in the U.S., according to forecasts released today by the National Retail Federation (NRF) and eMarketer. Both firms expect to see overall retail sales growth during November and December, though the market may be impacted by slowing brick-and-mortar sales.

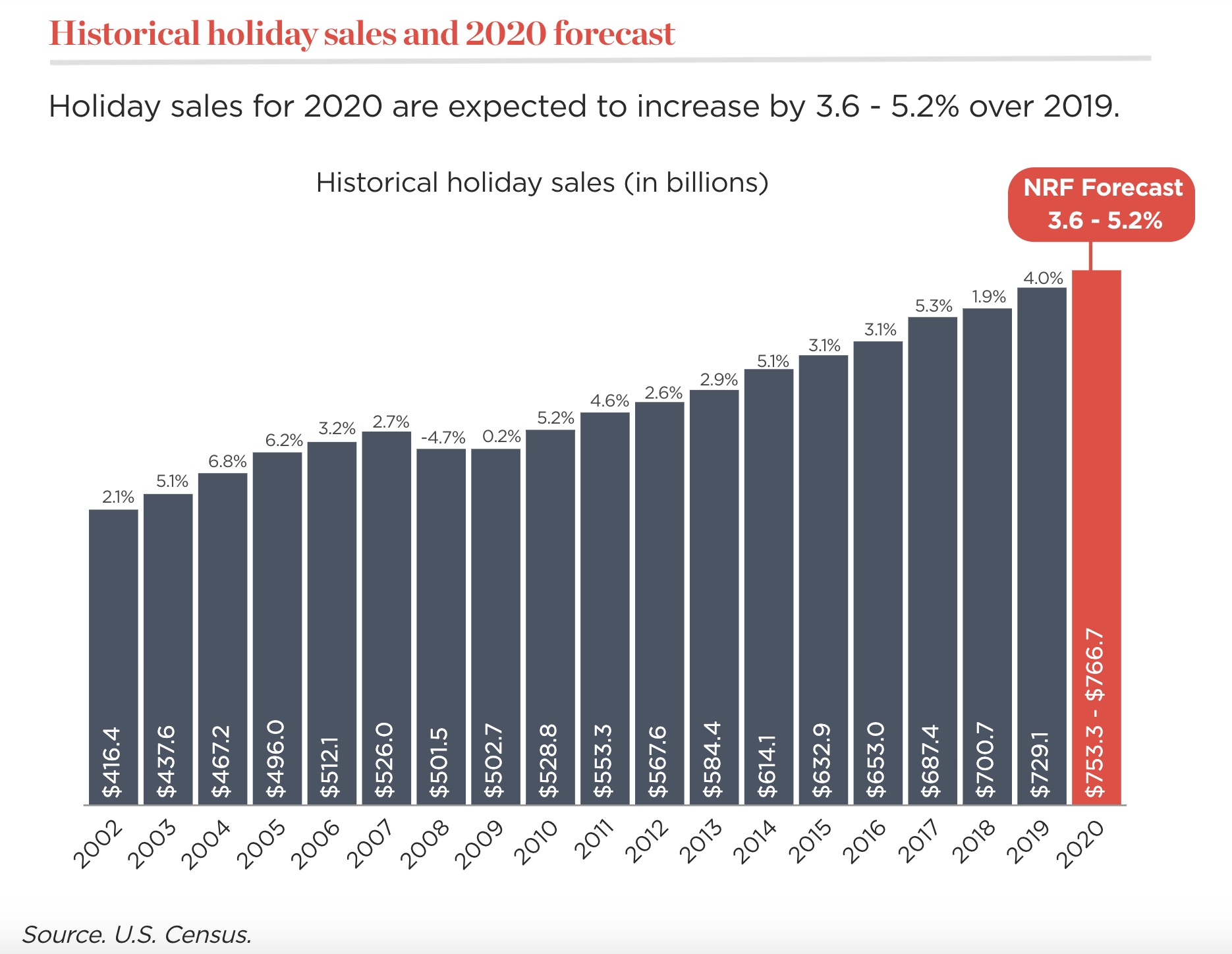

Of the two, NRF had the more optimistic forecast. It estimates U.S. holiday sales during November and December will increase between 3.6% and 5.2% year-over-year, for a total between $755.3 billion and $766.7 billion. That's compared with a 4% increase in 2019 to $729.1 billion, and an average of a 3.5% increase over the past five years.

Image Credits: NRF

Growth will come from online and other non-store sales, which are included in the total, which will increase between 20% and 30% to reach between $202.5 billion and $218.4 billion. That's up from $168.7 billion last year.

NRF's takeaway is that consumers are willing to spend â€" perhaps because of the challenging year that 2020 has been, rather than despite it.

'After all they've been through, we think there's going to be a psychological factor that they owe it to themselves and their families to have a better-than-normal holiday,' noted NRF Chief Economist Jack Kleinhenz. 'There are risks to the economy if the virus continues to spread, but as long as consumers remain confident and upbeat, they will spend for the holiday season,' he added.

The firm also noted Americans may have reduced their spending in other categories, like personal services, travel and entertainment due to the pandemic, which could increase the money they have for retail spending.

eMarketer, on the other hand, paints a less rosy picture when it comes to overall sales.

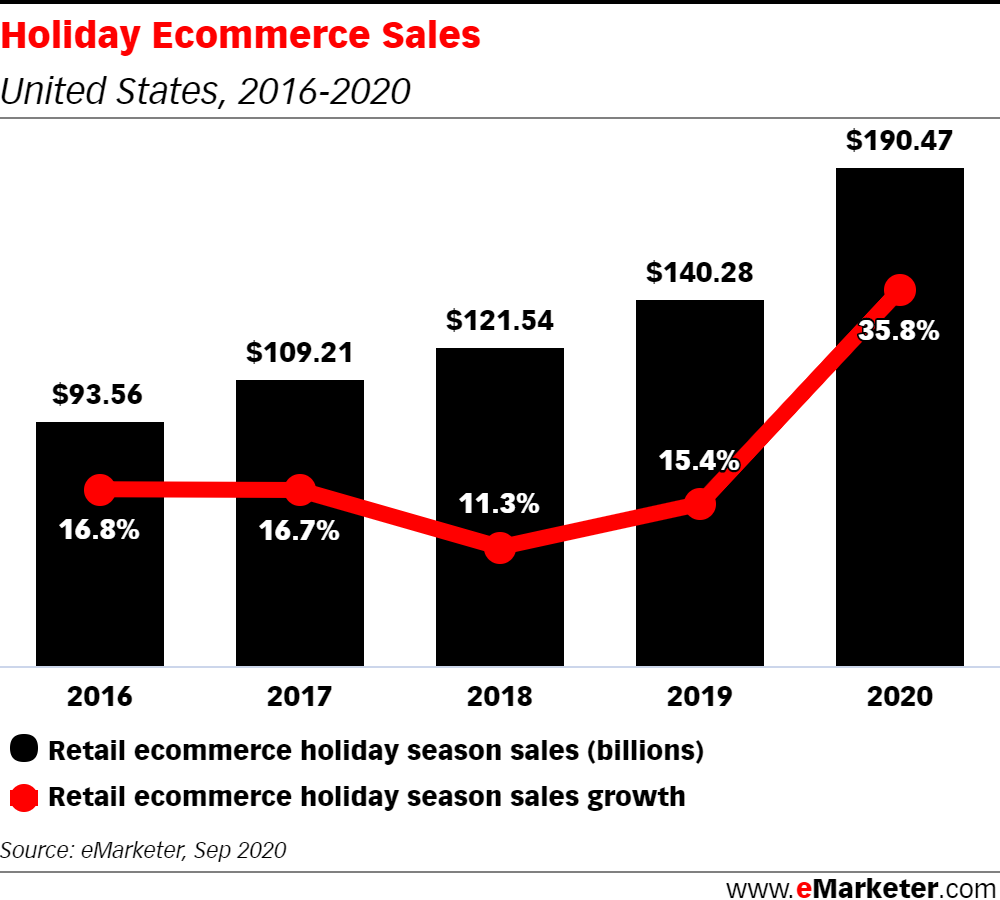

The firm predicts that total holiday season retail sales will see the lowest growth rate at just 0.9% year-over-year. This growth will come from the e-commerce sector, which will see its highest growth rate â€" 35.8% â€" since the firm began tracking retail sales in 2008. Brick-and-mortar sales, on the other hand, will decline 4.7%.

The discrepancy between these two firms' estimates have to do with how they calculate 'retail sales.'

eMarketer's estimates include auto and gasoline sales, but exclude restaurants, travel, and event sales. NRF's figures, on the other hand, exclude auto, gasoline and restaurants.

However, both agree on an e-commerce surge. NRF notes online sales were already up 36.7% year-over-year in the third quarter â€" in part, due to early holiday shopping. This year, some 42% of consumers had started shopping earlier than usual, it recently found. Plus, retail sales were up 10.6% in October 2020 versus October 2019, in aggregate, its forecast noted.

But whether it's 20% to 30% growth or 35.8%, depending on the firm, it's clear e-commerce is saving the day here.

NRF also expects seasonal hiring to be in line with recent years, as retailers hire between 475,000 and 575,000 seasonal workers compared with 562,000 in 2019. Some of that hiring may have already taken place in October, due to early shopping, it said.

Though Black Friday may not see the same levels of in-person shopping as in years past, brick-and-mortar retailers have made it easier to shop digitally, then either have items shipped home, picked up in-store, or even curbside. Outside of Amazon, Walmart and Target have particularly benefited from investments in e-commerce, as both retailers easily beat Wall St. expectations in their latest earnings reports, released just ahead of the holiday quarter.

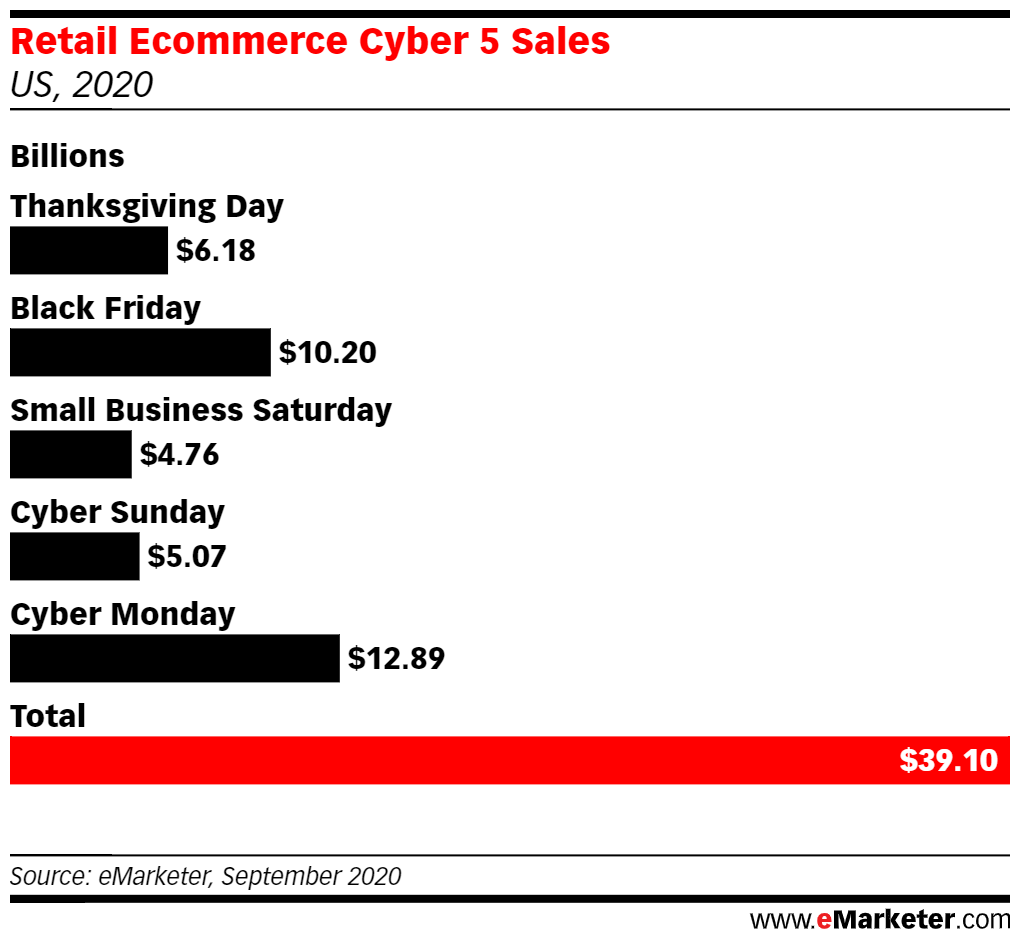

Online, however, Cyber Monday will continue to rule, however, eMarketer says.

Image Credits: eMarketer

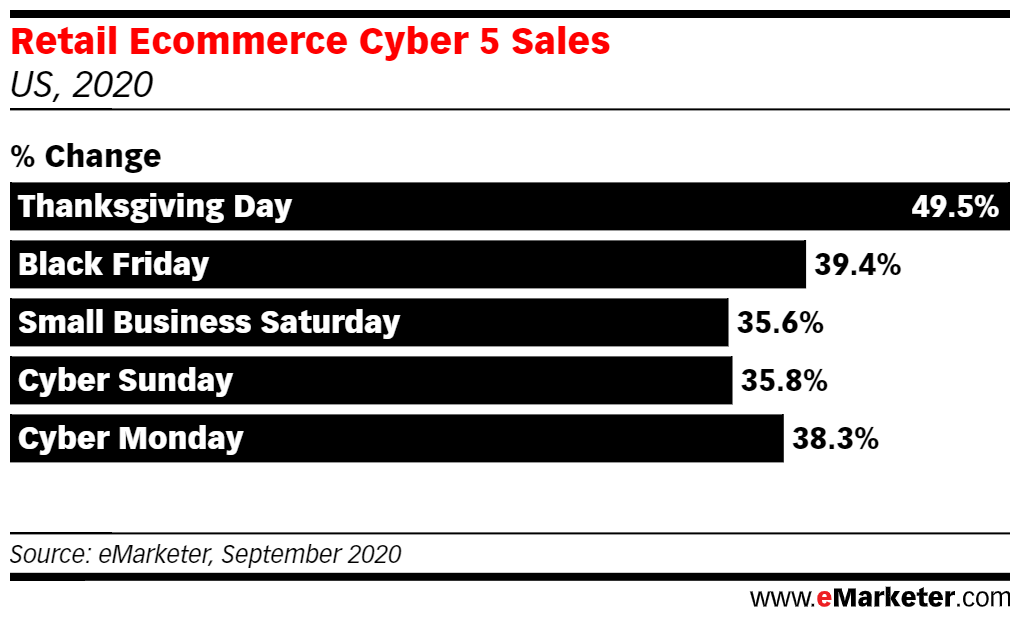

Of the five big online shopping days in 2020, eMarketer says Cyber Monday will again beat out Black Friday in terms of overall e-commerce sales, at $12.89 billion compared with Black Friday's $10.20 billion. But Thanksgiving Day will see the most year-over-year growth in e-commerce sales, at 49.5%, followed by Black Friday, Small Business Saturday, Cyber Sunday and Cyber Monday.

Image Credits: eMarketer

No comments:

Post a Comment